iowa city homestead tax credit

That amount may then be. 701-801 - Homestead tax credit.

Have you applied for your homestead tax credit.

. Web Iowa Code section 5612 defines the amount of property that qualifies for homestead treatment and these same definitions apply to the Disabled Veteran Tax Credit. Web Disabled Veteran Homestead Property Tax Credit Iowa Code section 42515 and Iowa Administrative Code rule 7018013 54-049a 10192020 This application must be. If you havent youre spending more than you need to on your p.

It is the property owners responsibility to apply. 54-028a 090721 IOWA. To be eligible a homeowner must occupy.

Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit. Web Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Web Iowa City Assessor 913 S.

Web What is the Credit. Web Homestead Tax Credit Iowa Code chapter 425 and Iowa Administrative Code rule 701 801. Web Attention homeowners in Johnson County Iowa.

Web The Homestead Tax Credit is a small tax break for homeowners on their primary residence. Iowa City Assessor. Any property owner in the State of Iowa who lives in the property can receive a homestead tax credit.

Web What is a Homestead Tax Credit. If you live in the greater Iowa City area in Johnson County you can apply for the. Web IOWA To the Assessors Office of CountyCity Application for Homestead Tax Credit Iowa Code Section 425 This application must be filed or mailed to your city or county assessor.

To be eligible a homeowner must occupy the homestead. Web Homestead Tax Credit July 1st Any person who owns and occupies his or her home. This application must be filed or postmarkedto your city or.

913 S Dubuque St. Web This rule making defines under honorable conditions for purposes of the disabled veteran tax credit and the military service tax exemption describes the application requirements. 701-801 - Homestead tax credit.

Web Sioux City IA 51101. 52240 The Homestead Credit is. This application must be filed or postmarkedto your city.

No homestead tax credit. Any property owner in the State of Iowa who lives. 54-028a 090721 IOWA.

1 Application for credit. Iowa law provides for a number of exemptions and credits including Homestead Credit and Military Exemption. Web Homestead Tax Credit.

The Homestead Credit is calculated by dividing the homestead credit value by 1000 and multiplying by the Consolidated Tax Levy Rate. Web Dubuque County Courthouse 720 Central Avenue PO Box 5001 Dubuque IA 52004-5001 Phone. That amount may then.

52240 The Homestead Credit is available to all homeowners who own and occupy the. The owner must occupy the dwelling as a home at least six months out of the year including. Web The Homestead Credit is calculated by dividing the homestead credit value of 485000 by 1000 and multiplying by the Consolidated Tax Levy Rate.

Web Instructions for Homestead Application You must print sign and mail this application to.

Iowa S Largest Property Tax Cut Fails To Deliver Investigation Finds

18 States With Full Property Tax Exemption For 100 Disabled Veterans The Definitive Guide Va Claims Insider

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Expiring Iowa Tax Credit Called Enormously Successful For Solar Energy Job Creation The Gazette

Hecht Group In Iowa Seniors May Be Eligible For A Property Tax Exemption Of Up To 4 000

Iowa City Homestead Form Process Johnson County

6 Things To Know About Homestead Exemptions Newhomesource

Iowa Property Tax Credit Certification Application State Historical

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Iowa Homestead Tax Credit Morse Real Estate Iowa And Nebraska Real Estate

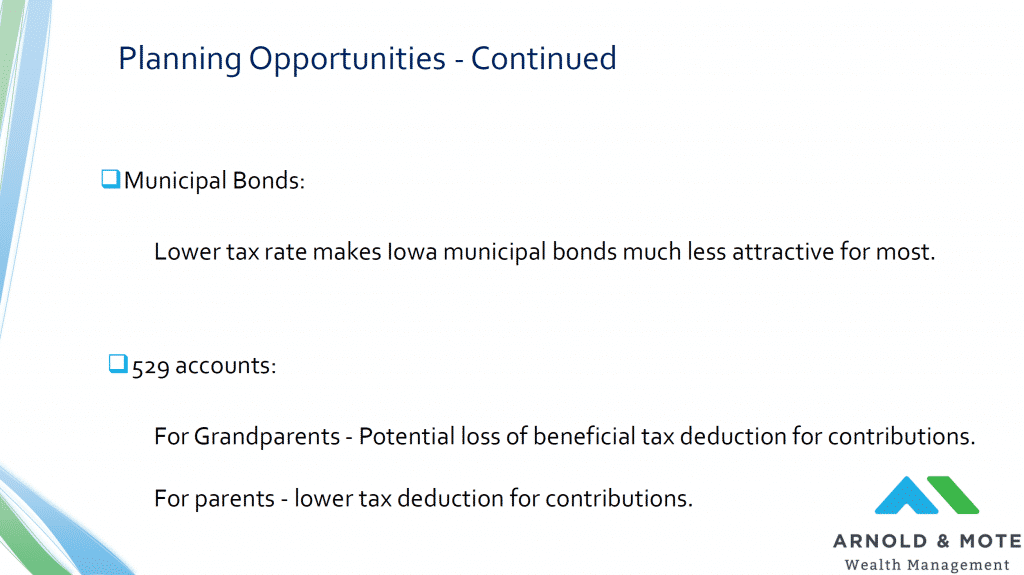

New Iowa Flat Tax Law Impact On Retirees Arnold Mote Wealth Management

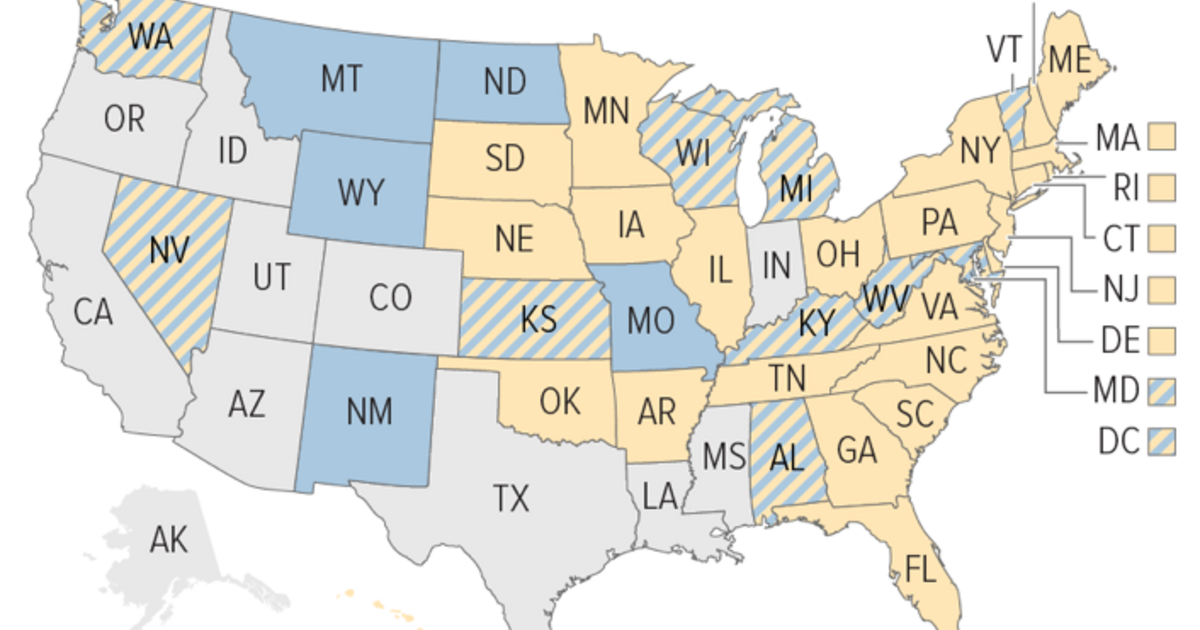

State Tax Treatment Of Homestead And Non Homestead Residential Property

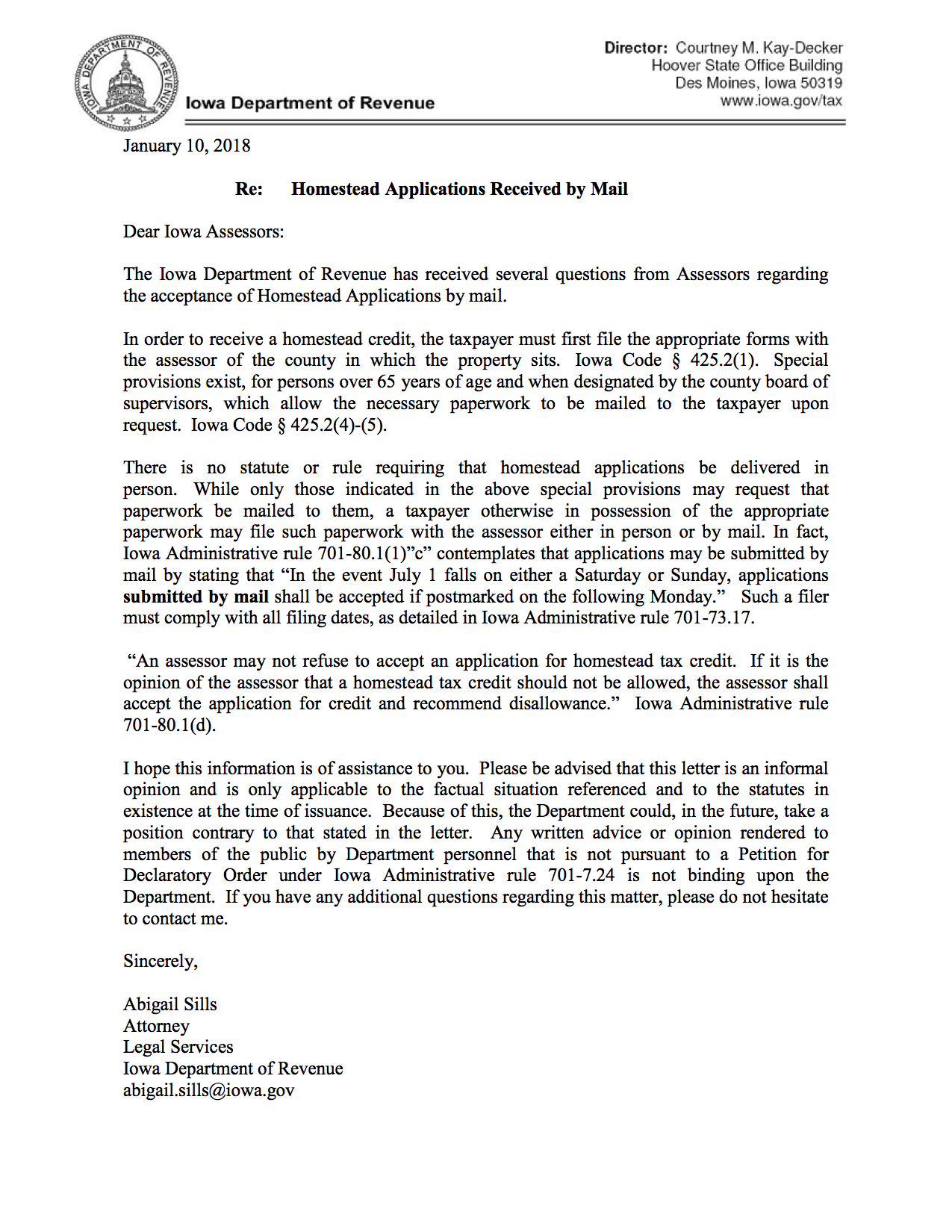

Update Regarding Homestead Tax Credit Applications Laughlin Law Firm Plc Jason Laughlin Managing Attorney

Frequently Asked Questions For The Iowa State Association Of County Auditors

Property Taxes By County Interactive Map Tax Foundation