salt tax new york state

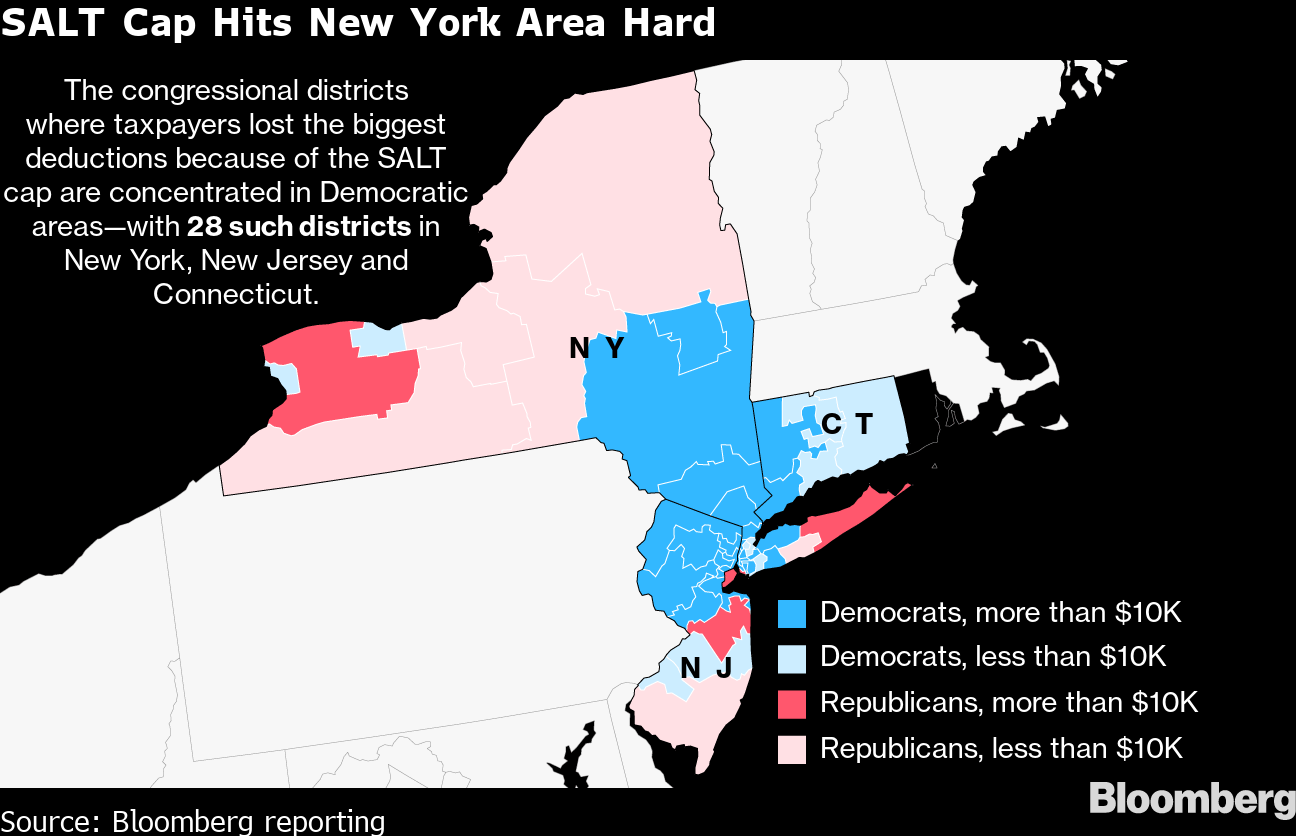

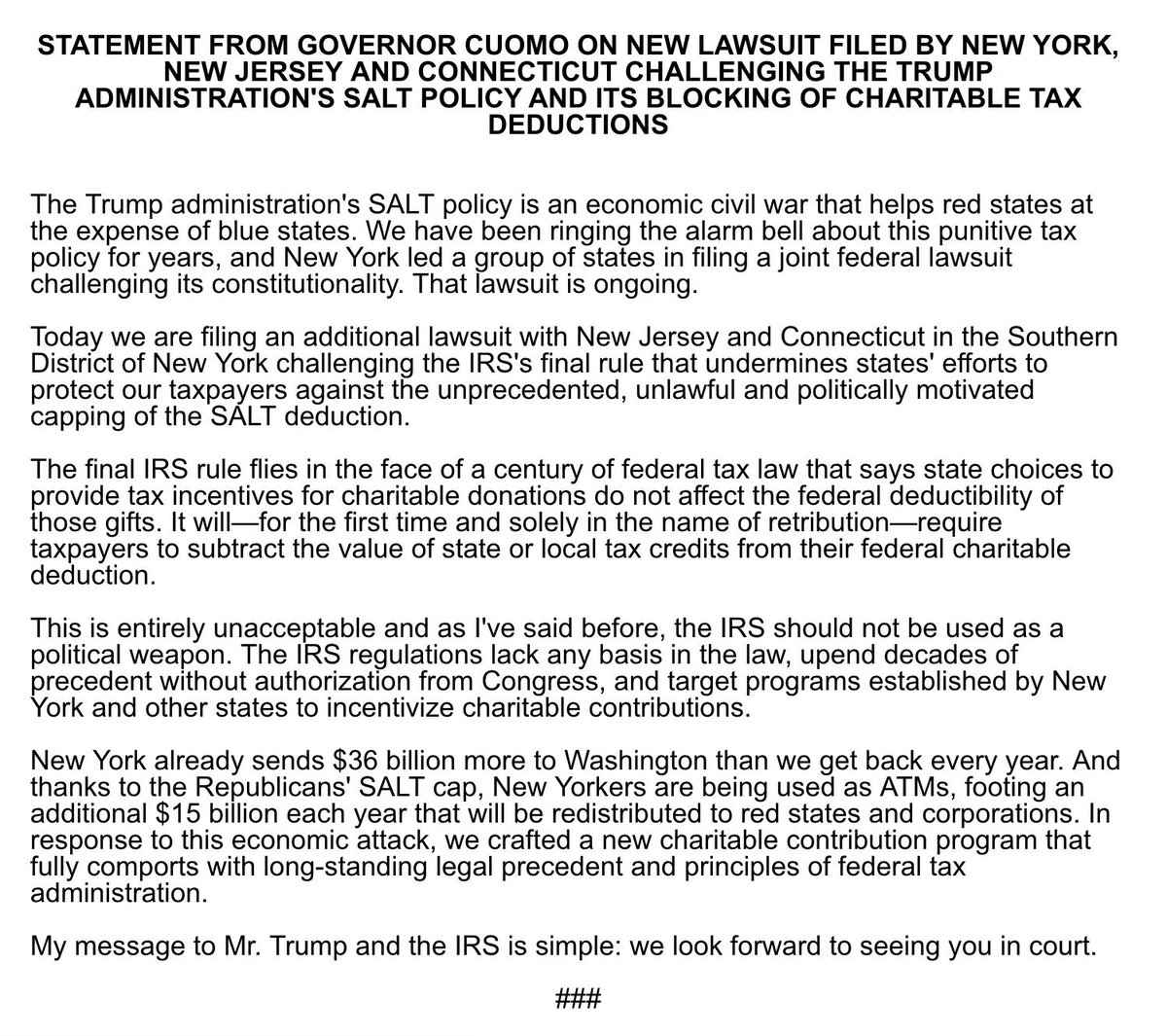

Whats worse is that the law. Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states.

State Pass Through Entity Taxes Let Some Residents Avoid The Salt Cap At No Cost To The States Tax Policy Center

Marcum LLP is an Equal Opportunity Employer.

. In this episode of the SALT Shaker Podcast Eversheds Sutherland Associates Jeremy Gove and Chelsea Marmor dive in to the history of. The Supreme Court on Monday declined to review a challenge to the 10000 ceiling imposed on the state and local tax SALT deduction one of the most controversial. We are seeking someone who thrives in a growing environment and providing clients with exceptional services.

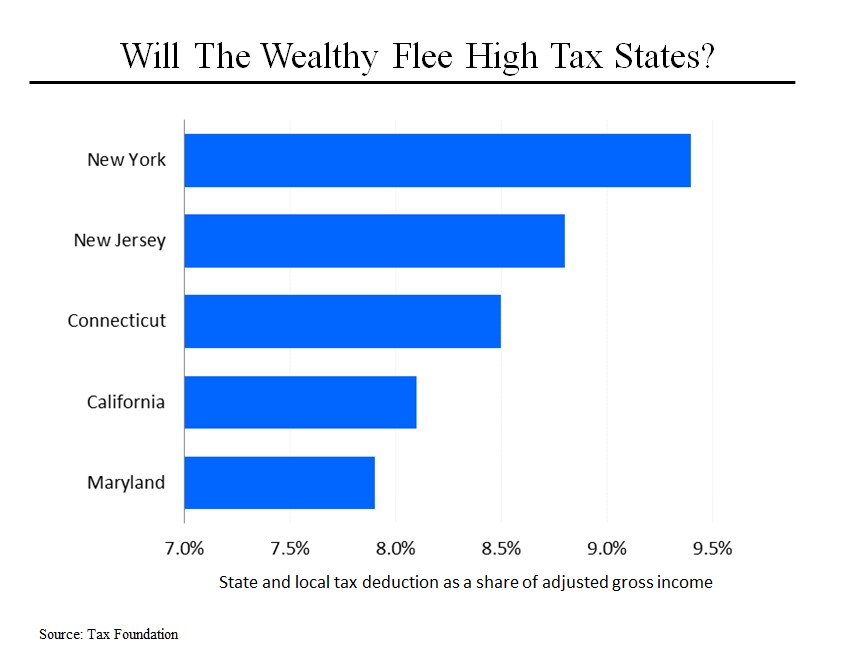

Andrew Cuomo and the state legislature agreed to the fiscal year 2022 budget making a number of changes to the states tax code through. The new New York. The cap affects high tax states like New York.

The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. Tom Suozzis letter Fighting the SALT Cap on Behalf of New York Aug. With the SALT limitation in place New.

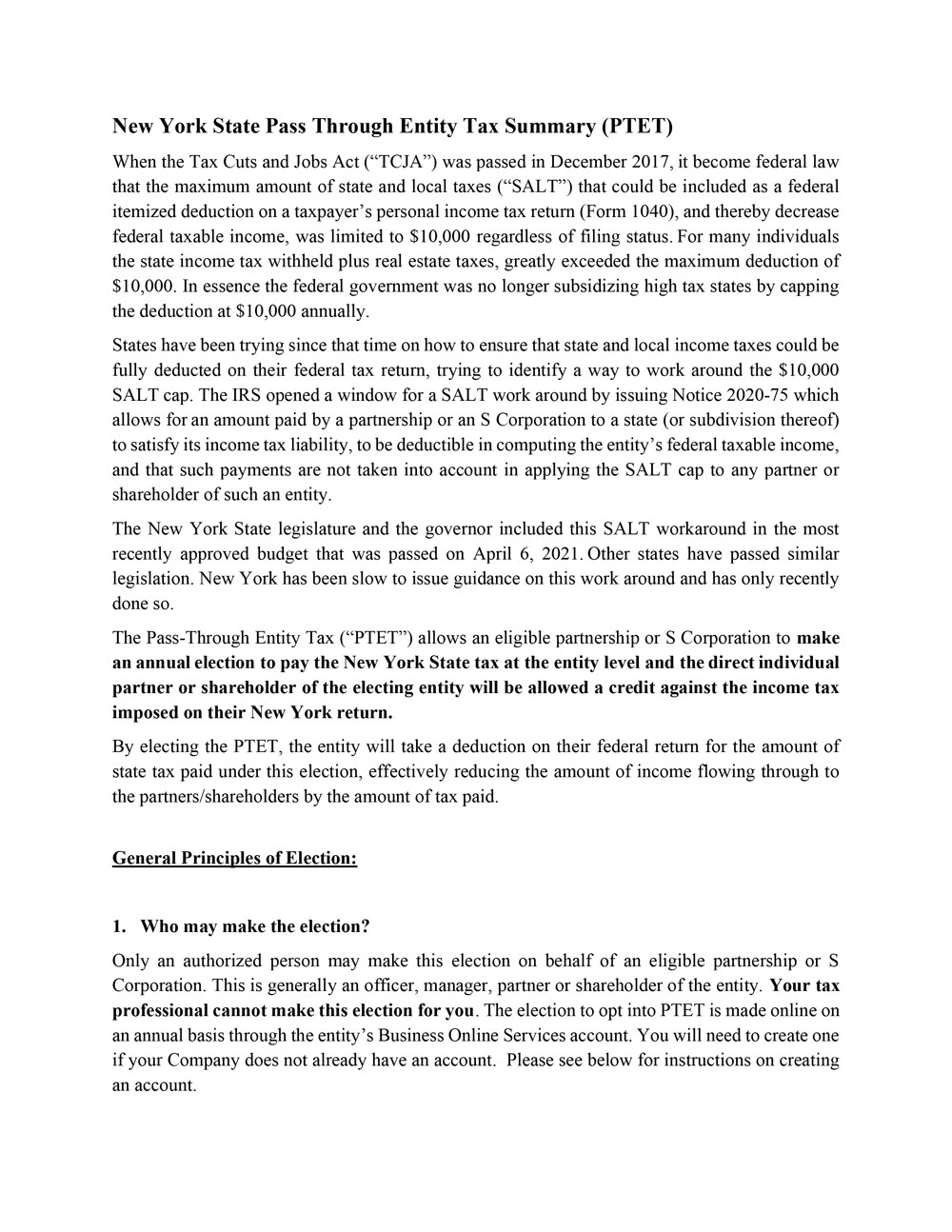

New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. The SALT cap limits a. On April 6 2021 New York Gov.

The Pass-Through Entity tax allows an eligible entity. A reasonable estimate of the current range is 85000-115000. The Debate Over a Tax Deduction.

Assist with state tax return review engagements focused on identifying and securing state income tax refunds Assist multi-state companies with state and local tax controversies. Corporate tax reform edition. Readers react to an editorial calling for the elimination of the deduction for state and local taxes and discuss how it affects the middle.

Why should someone in Pennsylvania earning 100000 pay more federal income tax. Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion.

Marcum LLP does not discriminate on the basis of race ancestry. The 10000 cap on state and local tax deductions for now may be here to stay however. 52 rows The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns.

EisnerAmper is seeking a Director to join their State and Local Tax practice. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after. Friday December 18 2020.

New York has issued long. 16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability. New York State legislature included a SALT workaround in the most recently approved budget passed on April 6 2021.

Despite frustration the so-called SALT Caucus failed to remove the 10000 cap on the state and local tax deductions -- popularly known as SALT -- as part of the recent.

![]()

Salt Shaker Eversheds Sutherland State Local Tax

Analysis For Mass High Earners Tax Law S Cuts Will More Than Make Up For New Salt Cap Wbur News

New York State Pass Through Entity Tax Welker Mojsej Delvecchio

More New York Businesses Using State Law To Avoid Salt Tax Cap Wsj

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/22441883/SALT_tax_deduction_poll_Data_for_Progress.png)

Salt Tax Repeal Democrats Weigh Restoring The State And Local Tax Deduction Vox

Avoiding The Salt Limitation New York Enacts A Pass Through Entity Tax To Help Taxpayers Work Around The Salt Limitation Wffa Cpas

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

Pass Through Entity Tax 101 Baker Tilly

Salt Tax Deduction Democrats Uncertain Over Ending Federal Cap

New York Expands Credits For Chip Manufacturers Grant Thornton

State Salt Cap Challenge Rejected By Second Circuit 1

Archive Governor Andrew Cuomo On Twitter Breaking New York Just Filed A Joint Lawsuit With N J And Connecticut Challenging The Trump Administration S Politically Motivated Salt Policy And Its Blocking Of Charitable Tax

Why This Tax Provision Puts Democrats In A Tough Place Time

The State And Local Tax Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Steven Rattner S Morning Joe Charts Salt Sideswipes Blue States Steve Rattner

Blue States Ask Supreme Court To Review Salt Tax Deduction Caps

We Don T Know If The Salt Cap Is Driving Away Residents Of High Tax States Tax Policy Center